2023 Open Enrollment Period

| Coverages | Minimum Coverage | Bronze | Silver | Gold | Platinum |

|---|---|---|---|---|---|

| Yearly Deductible | Individual: $9,100 | $6,300 | $4,750 | $0 | $0 |

| Prescription Drug Deductible | Included in Deductible | $500 | $85 | $0 | $0 |

| Out-of-Pocket Maximum | $9,100 | $8,200 | $8,750 | $8,550 | $4,500 |

| Primary Care Visit | 0% after deductible | $65 w/ deductible | $45 | $35 | $15 |

| Specialist Visit | 0% after deductible | $95 after deductible | $85 | $65 | $30 |

| Urgent Care | 0% after deductible | $65 after deductible | $45 | $35 | $15 |

| Emergency Room | 0% after deductible | 40% after deductible | $400 | $350 | $150 |

| Inpatient Services | 0% after deductible | 40% after deductible | 30% after deductible | $350/day | $250/day |

| Outpatient Services | 0% after deductible | 40% after deductible | 20% after deductible | $150 | $100 |

The Affordable Care Act (ACA) uses metal levels to categorize plans. When you’re trying to decide on the best metal level for you, consider how much coverage you want, your expenses, and what you can afford.Request a Quote

Affordable health insurance for low-income individuals and families through CoveredCA

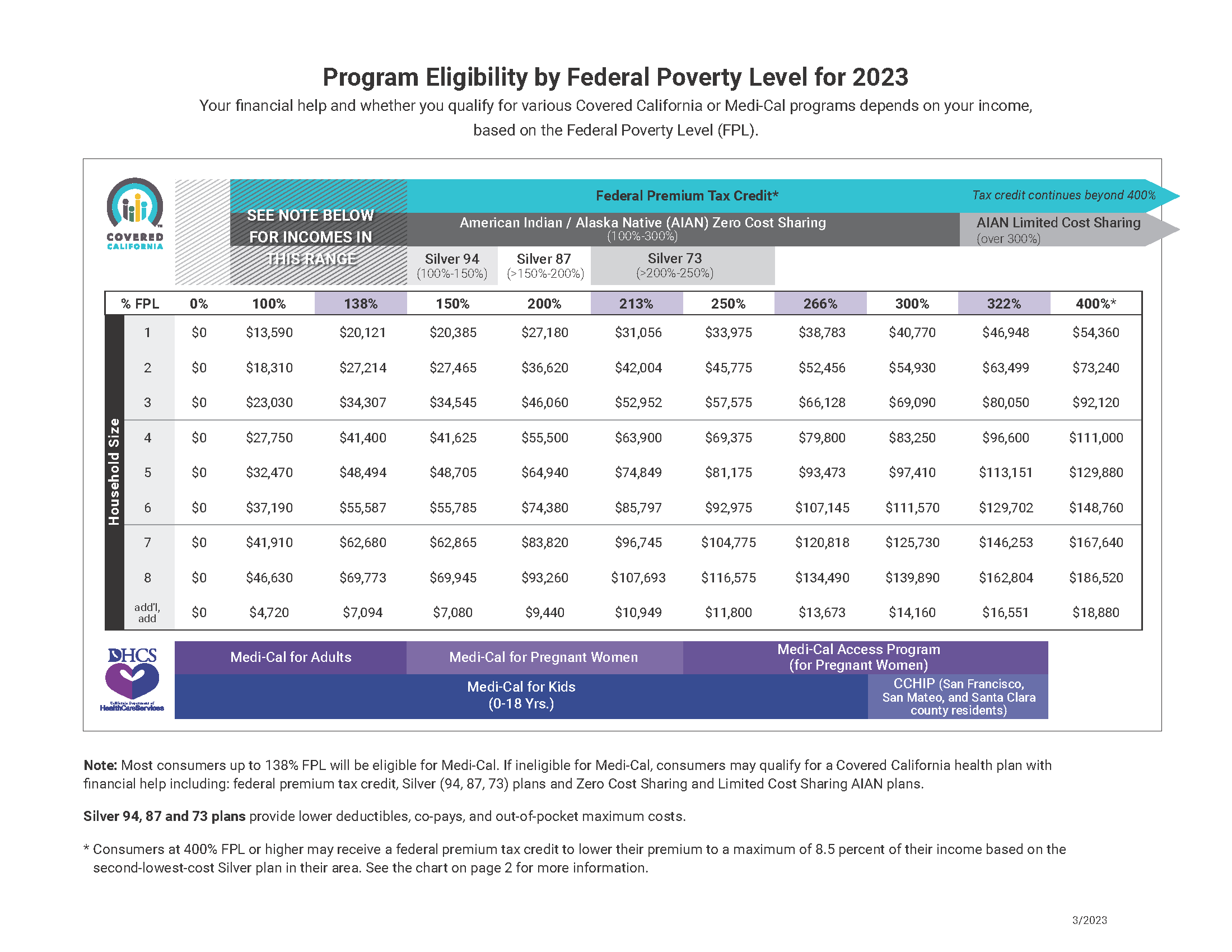

U.S. citizens and tax residents who meet certain income requirements may be eligible for government-subsidized health insurance. The amount of the subsidy is based on household size and income, and it can help to lower the cost of premiums. Families and individuals with incomes between 138% and 250% of the federal poverty line may be eligible for plans such as Silver 94, Silver 87, and Silver 73. These plans offer a variety of benefits and coverage options, and they can help to ensure that you have access to quality, affordable health care.

Frequently Asked Questions

-

Open Enrollment Period (OEP) in California is the time of year when you can sign up for health insurance through Covered California. This usually happens from November to January. Outside Open Enrollment, people who experience qualifying life events can apply during Special Enrollment.

The 2023 Open Enrollment Period for Covered California is from November 1, 2022 to January 31, 2023. During this time, you can:

• Compare health insurance plans: You can compare plans from different health insurance companies to find the one that best meets your needs and budget.

• Enroll in a health insurance plan: If you find a plan that you like, you can enroll in it during the Open Enrollment Period.

• Make changes to your existing health insurance plan: If you are already enrolled in a health insurance plan through Covered California, you can make changes to your plan during the Open Enrollment Period.

-

A Special Enrollment Period (SEP) is a time outside of the annual Open Enrollment Period when you can enroll in health insurance. You will need to apply for health insurance within 60 days of the qualifying life event.

There are a number of qualifying life events that allow you to enroll in CoveredCA if you missed enrolling during Open Enrollment. These events include:

• Losing your job

• Getting married

• Having a baby

• Moving

• Getting divorced

• Losing your health insurance through your employer

• Having a change in income -

CoveredCA is California's health insurance marketplace. It's a website where you can compare health insurance plans and apply for coverage. CoveredCA is a great resource for people who are looking for health insurance in California.

-

CoveredCA offers a variety of health insurance plans, including:

• Bronze: Lowest monthly premiums, highest out-of-pocket costs, insurance company pays 60% of expected medical expenses.

• Silver: Higher monthly premiums than bronze plans, lower out-of-pocket costs, insurance company pays 70% of expected medical expenses.

• Gold: Even higher monthly premiums than silver plans, lowest out-of-pocket costs, insurance company pays 80% of expected medical expenses.

• Platinum: Highest monthly premiums of all the metal tiers, offers the highest level of coverage, insurance company pays 90% of expected medical expenses.

-

The costs of health insurance can vary depending on the type of plan you choose, your age, your health, and your location. Some of the costs of health insurance include:

• Premiums: Premiums are the monthly payments you make to your insurance company.

• Out-of-pocket costs: Out-of-pocket costs are the costs you pay for medical care before your insurance company starts to pay. Out-of-pocket costs can include things like copays, coinsurance, and deductibles.

-

Health insurance can help you pay for your medical costs, including doctor's visits, prescription drugs, and hospital stays. It can also help you protect your financial health in case you become sick or injured.

-

If you don't have health insurance in California, you may have to pay a penalty at tax time. The amount of the penalty depends on your income and how many months you were uninsured. For the tax year 2023, the penalty is $850 per adult and $425 per child per month. A family of four that goes uninsured for the whole year would face a penalty of at least $2,550.

-

You can use the CoveredCA website to see if you qualify for financial help. You'll need to provide some information about your income and household size. If you qualify for financial help, you'll be able to get a subsidy to help you pay for your health insurance premiums.

-

Here are the documents you need to apply for subsidized health insurance from CoveredCA:

• Proof of identity: This can be a driver's license, passport, or other government-issued ID.

• Proof of citizenship or lawful presence: This can be a birth certificate, naturalization certificate, or other documentation showing that you are a U.S. citizen or lawful permanent resident.

• Proof of income: This can be a recent pay stub, tax return, or other documentation showing your income.

-

The amount of subsidy you can get from CoveredCA depends on your income and the size of your household. The subsidy is designed to help you pay for your monthly premiums, so you may be able to get a subsidy that covers all or most of your premiums.

The subsidy is calculated using a sliding scale, so the more you earn, the less subsidy you will receive. If you earn less than 138% of the federal poverty level, you may qualify for Medi-Cal, which is a government-funded health insurance program. If you earn between 138% and 400% of the federal poverty level, you may qualify for a subsidy on a CoveredCA plan.

To see how much subsidy you may be eligible for, you can use CoveredCA's subsidy calculator. The calculator will ask you for some basic information about your income and household size, and it will then estimate how much subsidy you may be eligible for.

Please refer to this chart to determine if you qualify for premium assistance.